Seniors Empowerment

Seniors Empowerment and Entrepreneurship Training (SEET)

Tax advisors will need the following information to help you complete your income tax and benefit return:

- Tax information slips – Provided by your employer, payer, or administrator (T4, T4E, T5, T5007, T4A, T4A (P), T4A (OAS); Pension T2202A; Tuition.

- Receipts (if applicable) – (Charitable donation, Medical/dental, Child Care, RRSP Contributions, Last Year’s Notice of Assessment)

- Social Insurance Number

- Government ID

- Bank account number for direct deposit

Steps:

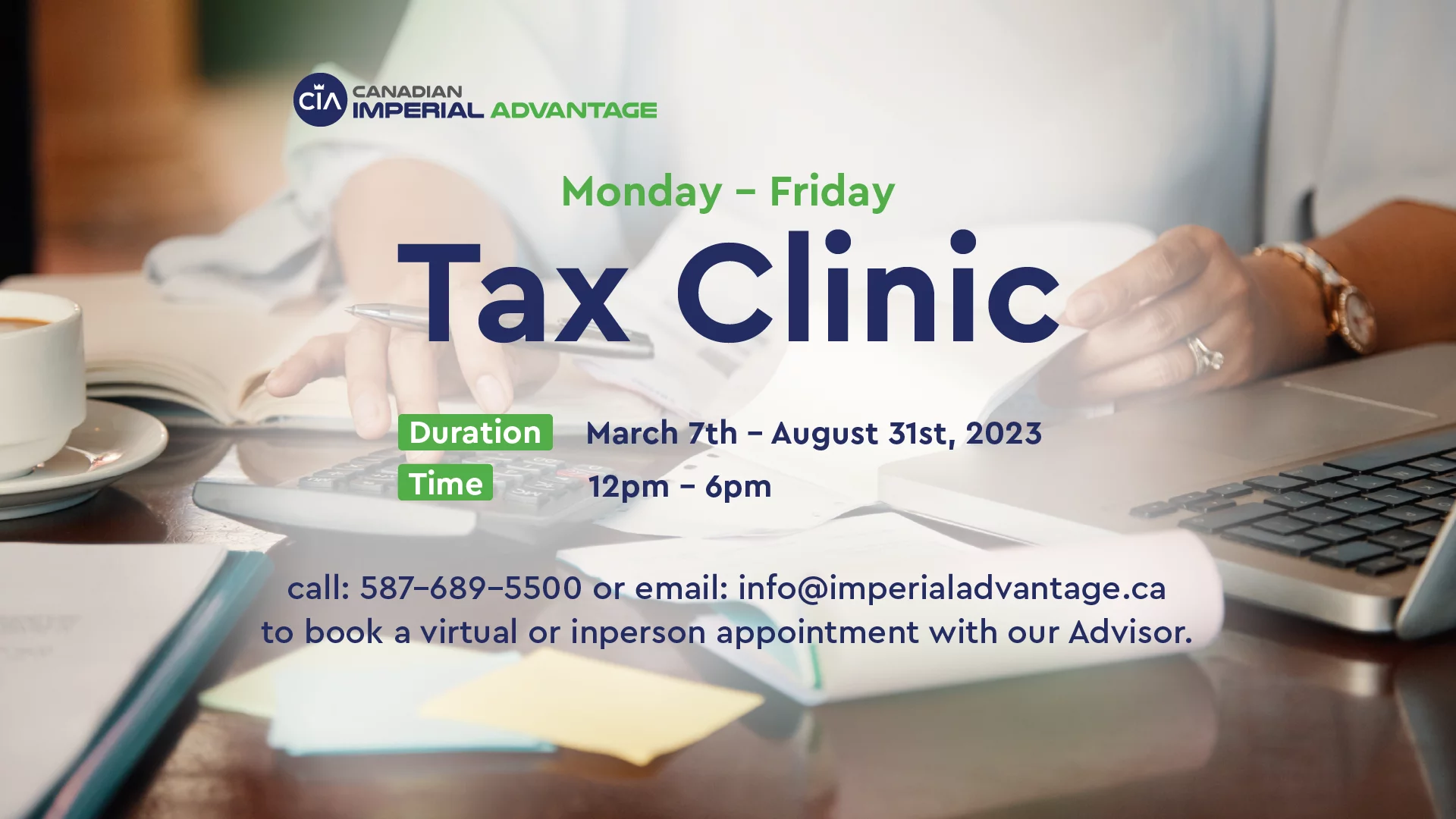

We will have tax professionals on-site every Tuesday between 12 p.m. and 4 p.m. to prepare tax returns or expert advice beginning March 3, 2023

- All documents will be used to complete your tax return.

- Your tax return will be available two (2) weeks after it has been completed

- Call 587-689-5500 to book a virtual or in- person appointment with the Advisor.

Combating:

- Ageism

- Celebrate diversity

- Promote inclusion

- Improve seniors’ access to government services and benefits

Entrepreneurship Training:

CIA is offering the following services to black seniors

- Business Consulting

- Tax filing

- Government Seniors Benefits – application preparation

- Business Seminars and Workshops

SEET Registration